General government deficit decreased last year, the debt level was stable (corrected on 24.03.2023)

According to the preliminary data of Statistics Estonia, in 2022, the Estonian general government deficit was 1% and the debt level was 18% of the gross domestic product (GDP). At the end of last year, the total expenditures of the general government exceeded revenues by 335 million euros.

The number marked in red was corrected in the news release.

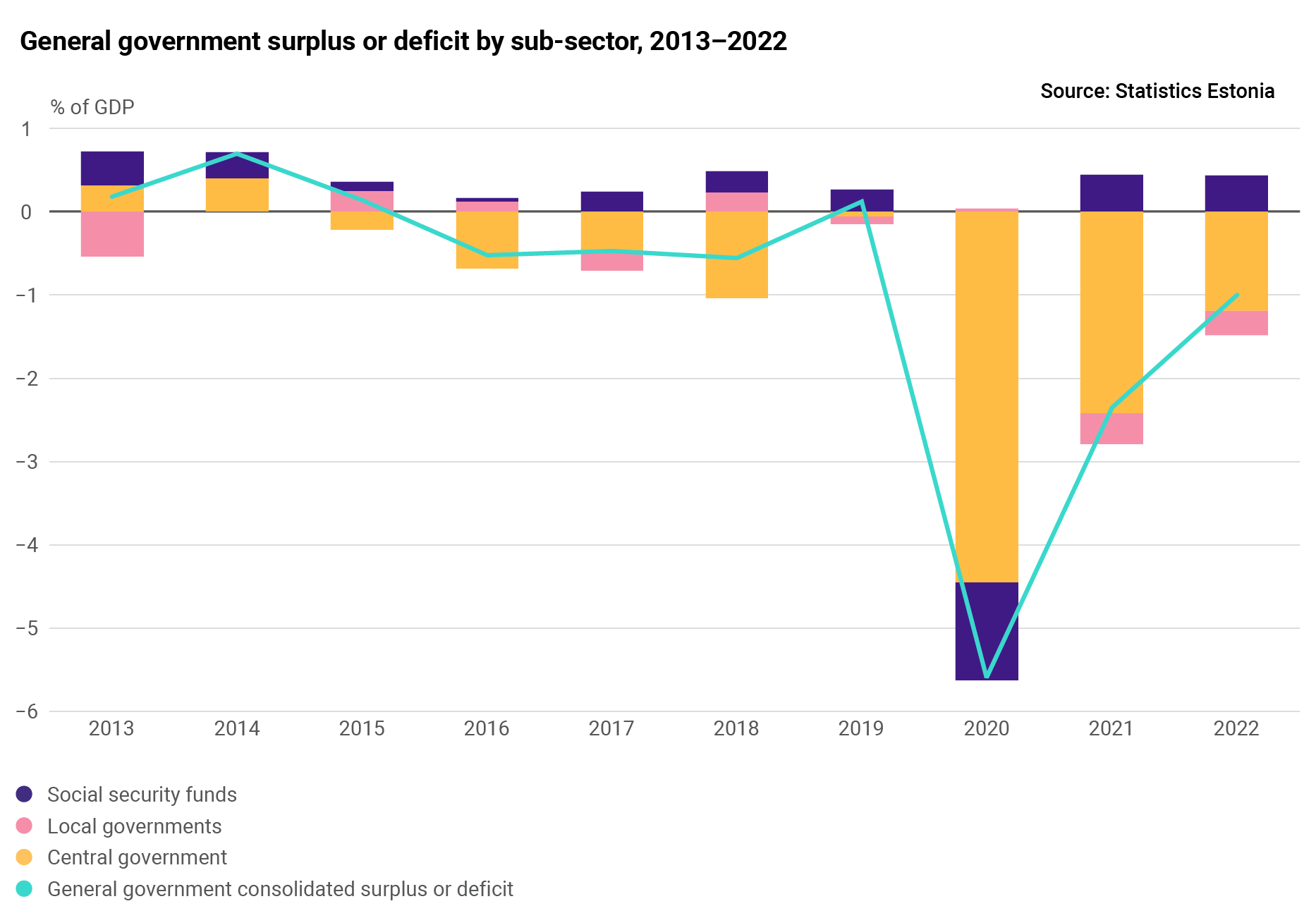

In Estonia, the general government sector comprises three sub-sectors: central government, local governments, and social security funds. Evelin Ahermaa, a team lead at Statistics Estonia, said that both the central government and local governments ended 2022 in deficit which was, respectively, 388 million euros and 104 million euros. “Similarly to 2021, there was again a significant improvement in the state of the central government budget – its deficit had been 785 million euros in 2021, mainly due to measures related to COVID-19. The deficit has been reduced by increased tax revenue: higher consumption and rapid inflation have boosted VAT receipts, while rising wages have meant more revenue from social tax and income tax. The rise in income tax receipts has also been influenced by the pension reform. On the other hand, for social security funds, revenues exceeded expenditures, resulting in a budget surplus of 157 million euros,” noted Ahermaa.

The general government consolidated debt (Maastricht debt*) increased and amounted to 6.7 billion euros by the end of 2022. There was a continued rise in the debt of both the central government and the local government sub-sector. The central government’s liabilities towards social security funds grew and totalled 1.1 billion euros. Year on year, there was a slight increase (4%) in long-term loan liabilities, while long-term debt security liabilities increased by 62%. The general government debt to GDP ratio remained stable as the GDP also grew.

The central government sub-sector includes state budget units and extra-budgetary funds, foundations, and legal persons in public law. The total debt of the central government increased by 22% compared with 2021, amounting to 6.8 billion euros by the end of 2022. Long-term loan liabilities increased marginally (by 2%), but there was a considerable growth in the volume of long-term securities because, at the end of last year, the government issued bonds with a maturity of 10 years in the total amount of one billion euros. Thus, the volume of long-term securities rose to 2.5 billion euros by the end of 2022 (up from 1.5 billion euros at the end of 2021). Foreign debt, i.e. liabilities towards the rest of the world, accounted for 68% of the central government’s loan liabilities.

The local government sub-sector includes city and rural municipality governments with their subsidiary units, and foundations. The local government consolidated debt was 987 million euros at the end of 2022. Long-term loan liabilities increased by 10%, but the volume of long-term securities continued the downtrend and decreased by nearly a fifth year on year. The share of foreign debt remained at the same level at 26% of local government debt.

Social security funds (i.e. the Estonian Health Insurance Fund and the Estonian Unemployment Insurance Fund) did not contribute to general government debt.

* General government debt, or Maastricht debt, refers to the liabilities of the general government units in the following categories: currency and deposits, debt securities, and loans. It is measured as a share of the gross domestic product (GDP). General government debt shows how much the state has borrowed and to what extent it holds the funds of other units.

The name derives from Maastricht criteria which, among other things, stipulate the general government debt limit for candidate countries to join the eurozone (the debt must not exceed 60% of the GDP). The debt is calculated without interest liabilities.

See also the government finance section on our website.

More detailed data have been published in the statistical database.

For further information:

Helen Maria Raadik

Media Relations Manager

Marketing and Dissemination Department

Statistics Estonia

Tel +372 625 9181

press [at] stat.ee